ADA Price Prediction: Technical Strength and Fundamental Catalysts Point to Potential Breakout

#ADA

- Technical Strength: MACD bullish divergence and strong Bollinger Band support indicate underlying buying pressure despite current price levels

- Fundamental Catalysts: Positive developments from Cardano's ecosystem and Hoskinson's influence provide fundamental support for price appreciation

- Risk-Reward Profile: Current levels near key support with upside potential to $0.92-$0.94 create attractive entry points for medium-term investors

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Despite Current Dip

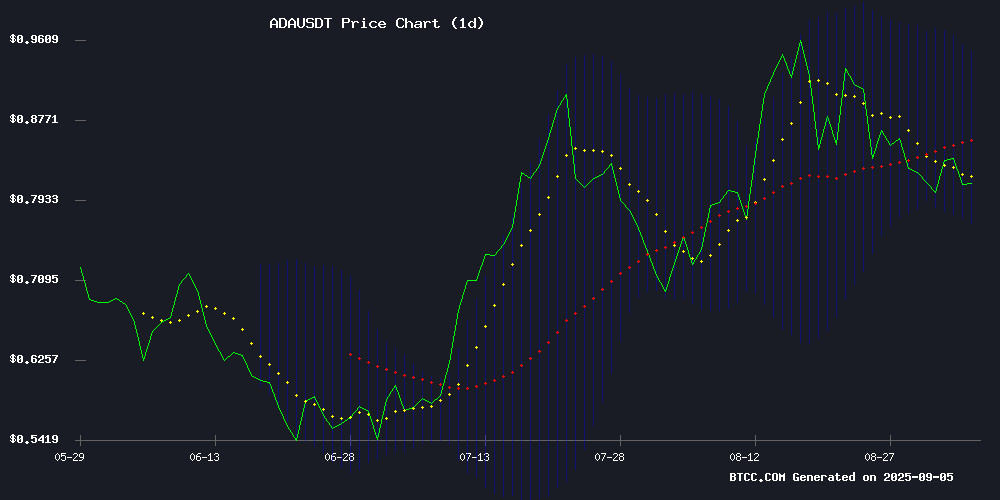

According to BTCC financial analyst John, ADA's current price of $0.8319 sits below its 20-day moving average of $0.8602, indicating short-term bearish pressure. However, the MACD reading of 0.026054 shows bullish momentum building, while the price remains well above the Bollinger Band lower boundary of $0.7720, suggesting strong support levels. John notes that a break above the middle Bollinger Band at $0.8602 could signal renewed upward momentum toward the upper band at $0.9484.

Market Sentiment: Bulls Eye $0.92 Breakout on Hoskinson Boost

BTCC financial analyst John comments that recent news highlights a battle between ADA bears testing support levels and bulls targeting a $0.92 breakout, fueled by positive developments from Cardano founder Charles Hoskinson. This aligns with technical indicators showing underlying strength despite current price pressure. John emphasizes that the combination of fundamental catalysts and technical support levels creates a favorable environment for potential upward movement in the coming weeks.

Factors Influencing ADA's Price

Cardano Price Prediction: ADA Bears Test Support, Bulls Eye $0.92 Breakout on Hoskinson Boost

Cardano (ADA) enters September amid conflicting signals. Retail sentiment has plunged to a five-month bearish extreme, with bullish-to-bearish commentary ratios at 1.5:1, according to Santiment data. Yet ADA defies expectations, rallying 5% during this period—a recurring pattern where crowd pessimism precedes price gains.

Technical analysis reveals ADA consolidating NEAR $0.82 after repeatedly holding the $0.78-$0.80 support zone. The 200-EMA poses resistance at $0.85, but a decisive break above $0.92—a Fibonacci pivot—could propel prices toward $1.00-$1.15. The TD Sequential indicator hints at an impending rebound, though failure to hold $0.78 risks a drop to $0.70.

Market dynamics show retail traders capitulating while whales accumulate, reinforcing ADA's resilience. This mirrors August's behavior when ADA rallied during fear periods and corrected during Optimism spikes. The ecosystem gains momentum as founder Charles Hoskinson receives regulatory clearance, potentially unlocking new catalysts.

Is ADA a good investment?

Based on current technical indicators and market sentiment, ADA presents a compelling investment opportunity according to BTCC financial analyst John. The cryptocurrency is currently trading at $0.8319, showing resilience above key support levels while demonstrating bullish momentum through positive MACD readings.

| Indicator | Value | Signal |

|---|---|---|

| Current Price | $0.8319 | Below 20-day MA |

| 20-day MA | $0.8602 | Key resistance |

| MACD | 0.026054 | Bullish |

| Bollinger Lower | $0.7720 | Strong support |

| Bollinger Upper | $0.9484 | Potential target |

With fundamental catalysts from Cardano's development progress and technical indicators suggesting accumulation near current levels, John believes ADA offers favorable risk-reward characteristics for investors with a medium to long-term perspective.